Table of Content

- Tricare For Life: Coverage Basics Enrollment & Costs

- Does Medicare pay for nursing homes?

- Nursing home expenses a policy will — and will not — pay for

- At-Home Preventive Health Care

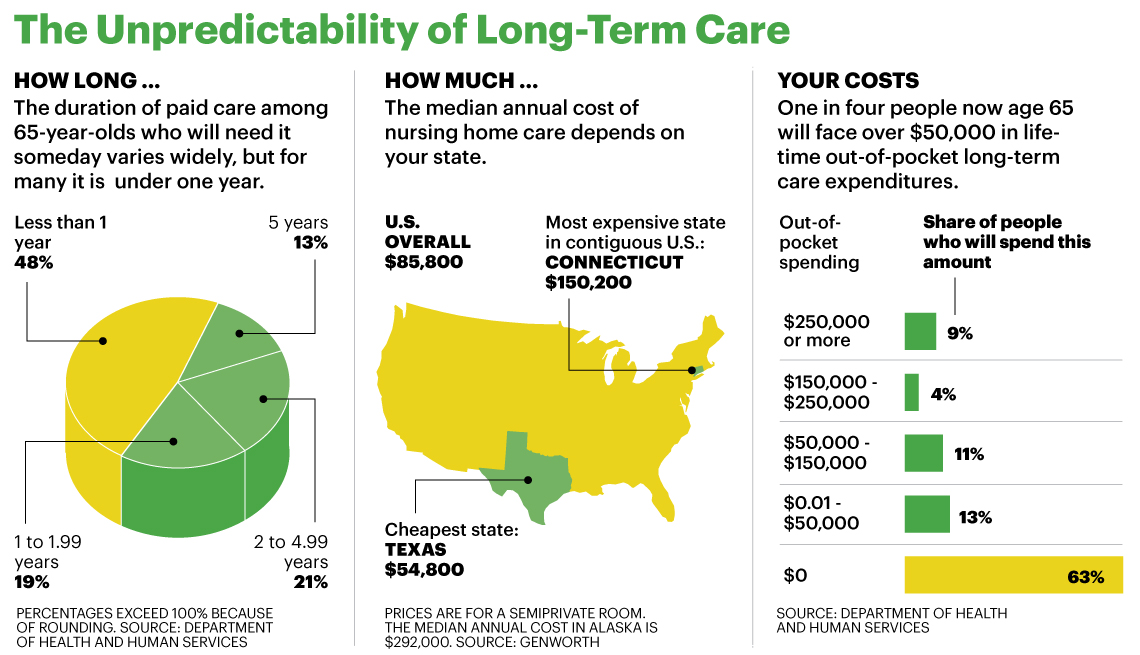

- Nursing Home or Long-Term Care Insurance

- Where to Buy Insurance for Contents in a Nursing Home

- What kind of care do I need?

- How do I file a claim with Petco?

Moreover, you will have the guarantee that you will be taken care of as you deserve, without spending all of your savings or becoming a money problem for your children. If you take a policy with a shorter elimination period, or none, then it will cost more. If you decide to take a longer elimination period, you are essentially agreeing to cover the costs yourself for a longer period before your policy starts to pay.

We compiled quotes from several cities nationwide to give you an idea of Petco’s pricing. These sample quotes are based on four-year-old dogs and cats of various breeds with a $250 deductible, 80% reimbursement, and a $10,000 annual limit. Looking into nursing home reviews and comparing facilities can be incredibly beneficial. Shereen Lehman, MS, is a healthcare journalist and fact checker.

Tricare For Life: Coverage Basics Enrollment & Costs

Barnes explains that an example of this could be a Medicare part A skilled nursing coinsurance of $185.00 per day or the 20% of therapy charges under Medicare part B. However, private insurance coverage varies tremendously depending on the insurance company plan, he says. If your elderly loved one requires nursing home care, there’s no doubt that you have a lot to consider; cost is likely one of the largest determining factors. If you need assistance with finding out whether or not your family member’s health insurance or Medicare coverage will assist with the cost of nursing home care, speak to a reputable insurance agent. Some long-term care insurance policies include support for seniors who move into assisted living facilities. While every policy is different, most plans with assisted living coverage reimburse beneficiaries for costs they’ve already paid out of pocket.

A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program. Medigap plans are optional supplemental plans that are also offered by private insurance companies. They are designed to help pay for some out-of-pocket costs, like deductibles and copays.

Does Medicare pay for nursing homes?

Feel free to contact MedicareInsurance.com today for more information about potentially available Medicare Advantage plans in your area. Medicare Part A, one half of what is known as “Original Medicare,” primarily covers in-hospital treatment. Medicare Part D covers prescription drugs only, regardless of the location where they are taken, but does not cover any nursing home stays. In some states, an unmarried person can also keep his or her home if declaring in writing, upon admission to the nursing home, an intent to return home. However, states that permit this usually put a 6- or 12-month limit on the length of time a resident can keep the home without actually returning to it. If a Medicaid nursing home beneficiary is allowed to keep a house, Medicaid will seek reimbursement from the value of the house when its sold.

In some cases, the VA will help pay for a veteran’s care at a State Veterans Home. A home must meet the VA standards for nursing home care to receive per diem aid. In addition, the VA will not pay more than half the cost of the veteran’s care. Assisted living facilities primarily help residents with non-medical needs. Although minor and infrequent medical services, such as first-aid for a wound, can sometimes be met on-site by nurses.

Nursing home expenses a policy will — and will not — pay for

In this type of case, a health insurance company or Medicare will cover a specific number of days; however, usually there are stipulations involved. For example, if your loved one does not attend a nursing home immediately following hospital discharge, medical insurance or Medicare may not pick up the bill. Certain Medigap plans may offer additional coverage for skilled nursing facility coinsurance in exchange for an extra monthly premium.

Also, it sometimes means that previously covered conditions may now be excluded as pre-existing under the new policy. Even the most comprehensive accident and illness insurance usually won’t cover routine care such as annual visits, bloodwork, and vaccinations. Keep in mind that each policy has its own definition of what constitutes a pre-existing condition. It’s the number one driver of dissatisfaction when it comes to pet insurance coverage.

Care in an assisted living facility costs on average $48,612 per year, a 68.79 percent increase from 2004. Financial organization Genworth tracked the cost of care in skilled nursing facilities and nursing homes from 2004 to 2019. Filling out our free, no-obligation online insurance verification form is the easiest and quickest method to determine if your TRICARE ADHD coverage includes ADHD assessments and treatment in Tennessee. Medicare Advantage may offer more support through its supplemental program, although individual insurers set their own policies to decide what additional coverage to provide. Medicare limits home health coverage to those who are homebound and for whom a doctor has prescribed home health care as being medically necessary.

Medicare.Org Is Privately Owned And Operated By Health Network Group, LLC. Medicare.Org Is A Non-Government Resource That Provides Information Regarding Medicare, Medicare Advantage, And More. We create unique, beautiful, compelling, and easy-to-understand guides and visualizations to help people make better financial decisions. Healthline has strict sourcing guidelines and relies on peer-reviewed studies, academic research institutions, and medical associations. You can learn more about how we ensure our content is accurate and current by reading our editorial policy. To diagnose and treat ADHD, a variety of specialists are available. Child psychiatrists, family physicians, pediatricians, psychiatrists, and neurologists are just a few examples.

It costs $9.99 per month for birds, fish, reptiles, or other small pets and $19.99 per month for dogs and cats. The cost reduces to $7.99 or $17.99 per month with the enrollment of multiple pets. The simplest way for people to pay for assisted living is out of pocket. This arrangement is much like paying rent on a normal apartment, as the person who handles the expense just writes a check every month. The relatively high cost of assisted living makes this difficult for many families, however, and even seniors with large retirement incomes may struggle to keep up with the cost. Even if you financially qualify for Medicaid, there may be copays for some services that youll need in long-term care.

Here are some tips that may help you understand the cost of nursing home insurance, so you can be sure you get the coverage you need at the best possible price. The nursing home insurance does not cover any payouts for your beneficiaries upon your death, protection of your property in a facility, or medical expenses. Jane (or her guardian/conservator) pays for the first 60 days out of pocket. After 60 days, the insurance policy reimburses the daily cost of up to $400 per day until the $400,000 is exhausted. Once or if the benefit limit is exhausted, Jane would start paying again.

Note that Petco will cover a preexisting condition if it is curable. If your pet has gone 180 days without symptoms or treatment, Petco will treat the condition as new if it recurs. In short, if the care received does not require a medical degree of some form to provide, Medicare is not responsible for covering the service.

Nursing home costs are expensive, so it's important to save money where you can. Long-term care insurance covers all or a portion of your fees for assisted living. This type of coverage is similar to a renters insurance policy and is usually available through any personal insurance company. As a result of the issues that can come with age, the elderly often require extra assistance.

Muscle mass decreases, eyesight deteriorates, cognitive health can decline; there are a number of complications that a person can experience as they age. If you or your loved one has Medicare Part D, your medications will typically be covered even if you live in a long-term care facility. This is because Medicare does not consider these things to be medically necessary. Unfortunately, what they also do not see as medically necessary are custodial care and long-term nursing home placement.

Pet insurance protects your bank account if your dog or cat is injured in an accident or diagnosed with a severe disease that requires expensive treatment. While pet insurance can be a great option, it’s crucial to understand precisely what you’re signing up for. All plans have waiting periods and pre-existing condition exclusions, and most accident and injury plans don’t cover routine care. Still, most insurers have wellness packages that provide reimbursement for wellness visits, routine blood work, and even vaccinations. Most owners don’t benefit from switching from one pet insurance plan to another because of how companies define pre-existing conditions. While reviewing your policy annually is helpful, changing pet insurance plans can be tricky as it often triggers new waiting periods.